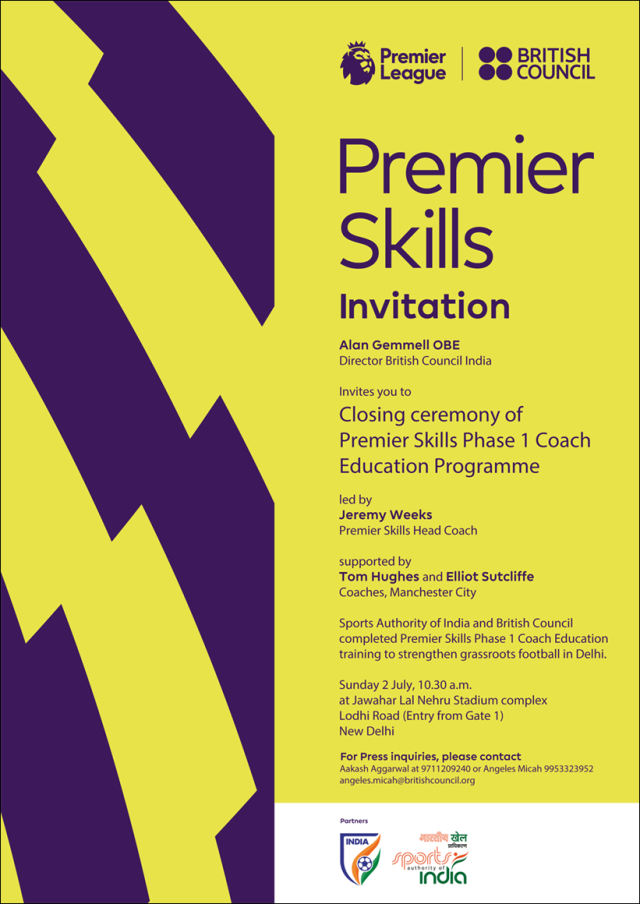

UKIndia2017 Premier League Closing Ceremony July 02 at 10.30 AM

Thanks and regards

Angeles Micah | Brand Manager, India |

British Council Division | British High Commission | 17, Kasturba Gandhi Marg | New Delhi – 110001 | India |

British Council Division | British High Commission | 17, Kasturba Gandhi Marg | New Delhi – 110001 | India |

T +00 91 11 42199000 | D + 00 91 11 41497240 | F +00 91 11 23357709 | M + 00 91 0 9953323952

E angeles.micah@in.britishcouncil.org

E angeles.micah@in.britishcouncil.org

British Council India | UKIndia2017 celebrate connect inspire

INVITE FOR BOOK DISCUSSION

INVITE FOR BOOK DISCUSSION ON 8 MAY AT 6.30 PM

Dear Friend

—

Dr.Mahalingam M

Research Fellow

Centre for Policy Analysis

C-17, Second Floor,

Green Park Extension,

New Delhi – 110016

Ph:- 011-26176992

Website: www.cpadehli.org

RBI decides to set up a new system

RBI decides to set up a new system for monitoring foreign investment limits in listed Indian companies

Attention of Authorised Dealer Category-I (AD Category-I) banks is invited by RBI to Foreign Exchange Management (Transfer or Issue of Security by a person Resident outside India) Regulations, 2017 notified vide Notification No. FEMA 20(R)/2017-RB dated November 07, 2017 and as amended from time to time, in terms of which the onus of compliance with the sectoral/ statutory caps on foreign investment lies with the Indian investee company.

Currently, Reserve Bank of India receives data on investment made by Foreign Portfolio Investors (FPI) and Non-resident Indians (NRI) on stock exchanges from the custodian banks and Authorised Dealer Banks for their respective clients, based on which restrictions beyond a threshold limit is imposed on FPI/ NRI investment in listed Indian companies.

In order to enable listed Indian companies to ensure compliance with the various foreign investment limits, Reserve Bank in consultation with Securities and Exchange Board of India (SEBI), has decided to put in place a new system for monitoring foreign investment limits, for which the necessary infrastructure and systems for operationalizing the monitoring mechanism, shall be made available by the depositories. The same has been notified by SEBI vide Circular-IMD/FPIC/CIR/P/2018/61 dated April 05, 2018 read with Circular- IMD/FPIC/CIR/P/2018/74 dated April 27, 2018.

In terms of para 6 of Annexure A of the circular dated April 05, 2018, all listed Indian companies are required to provide the specified data/ information on foreign investment to the depositories. The requisite information may be provided before May 15, 2018. The listed Indian companies, in non-compliance with the above instructions will not be able to receive foreign investment and will be non-compliant with Foreign Exchange Management Act, 1999 (FEMA) and regulations made there under.

All Authorised Dealer Banks are advised to instruct their clients and respective Indian companies, about the system requirement at para 4 of this circular. Further, upon implementation of the new monitoring system, all Authorised Dealer banks would be required to provide the details of investment made by their respective NRI clients to the depositories in the format as provided by the depositories/ SEBI. In addition, the reporting to Reserve Bank in the existing system, viz., LEC (NRI) and LEC (FII), would continue.

AD Category-I banks may bring the contents of this circular to the notice of their customers / constituents concerned. The directions contained in this circular have been issued under sections 10(4) and 11(1) of the Foreign Exchange Management Act (FEMA), 1999 (42 of 1999) and are without prejudice to permissions / approvals, if any, required under any other law.

Interaction with Mr. Serhii Sukhomlyn, Mayor of Zhytomyr Ukraine

Thank you for confirming your presence for the Interaction with Mr. Serhii Sukhomlyn, Mayor of Zhytomyr Ukraine on 7 May 2018 from 1000 hrs onwards at the Hall No 3 Pravasi Bhartiya Kendra (PBK), Chanakyapuri.

The objective of Mayor’s visit to India is look for business prospects in the fields of IT, solar energy, and infrastructure projects among others. A brief profile of Mayor is enclosed for your reference.

Request you to arrive before 10 AM. In case of anything, please do not hesitate to call/text me at 8860030312.

Looking forward to meeting you on Monday, May 7th at 10 AM.

Important announcements and approvals in Board Meeting of PFRDA

Pension Fund Regulatory and Development Authority (PFRDA) is established by the Government of India for regulation and development of Pension Sector in order to protect the old age income security of subscribers. PFRDA takes various initiatives from time to time in order to simplify and improve the operational issues in National Pension System (NPS) like new functionality development under NPS architecture, simplification of account opening, withdrawal, grievance management etc.

In this regard, during the recently held Board Meeting some important decisions were taken to improve the operational and regulation issues in National Pension System (NPS). Some of the decisions taken in the Board Meeting are as follows:

· Budget announcement- Rating criteria for investments- Proposal on changing the investment grade rating from ‘AA’ to ‘A’ for corporate bonds was approved. The change is subject to a cap on investments in ‘A’ rated bonds to be not more than 10% of the overall Corporate Bond portfolio of the Pension Funds. This initiative will enlarge the scope of investment for the Fund Managers while ensuring credit quality.

· Introduction of a Common Stewardship Code: The proposal on adoption of Common Stewardship Code, as a measure of good Corporate Governance, was approved. Further, it was also approved that the Principles enumerated in such code shall be circulated to all Pension Funds for compliance and implementation. Adoption of these Principles by Pension Funds will improve their engagement with investee companies and benefit subscribers.

· Modification in Partial Withdrawal rules under NPS: Partial withdrawals will now be allowed to NPS subscribers who wish to improve their employability or acquire new skills by pursuing higher education/ acquiring professional and technical qualifications. Further, individual NPS subscribers who wish to set up a new business/ acquire new business will also be allowed to make partial withdrawals from his contributions. Other terms applicable to partial withdrawals will remain unchanged.

· Increasing cap on equity investment in active choice to 75% from current 50% for Private Sector Subscribers: Presently there is a cap of 50% on equity investment under active choice in NPS. The proposal on increasing cap on equity investment in active choice to 75% from currently 50% has been approved by the Board. However, it comes with a clause of tapering of the equity allocation after the age of 50 years.

Currently, NPS and Atal Pension Yojna (APY) have a cumulative subscriber base of over 2.13 crore with total Asset Under Management (AUM) of more than Rs. 2.38 lakh crore.

CM Haryana visiting Israel and Britain

CM Haryana Mr Mohan Lal Khattar is visiting Israel & Britain to rope in Investment and during questions hours Media asked Is tour on govt expenses on this tour ,CM quickly added we r better than Punjab they are unable to pay salaries to their employees. Foreign tours for exploring collaboration for agriculture ,Water treatment, Security, Aviation, space, security and investment are the the sectors for which the state is seeking collaboration from Britain and Israel.

Badakhshan’s Kohistan District loss to Taliban

Afghan forces on Saturday retook Kohistan district in Afghanistan’s northeast province of Badakhshan, confirmed the country’s Interior Ministry.

Not divulging the details of the military operations, Interior Ministry spokesman Najib Danish said that the Taliban suffered heavy losses and the operation will continue to clear all the district from militants, reported TOLO News.

Not divulging the details of the military operations, Interior Ministry spokesman Najib Danish said that the Taliban suffered heavy losses and the operation will continue to clear all the district from militants, reported TOLO News.

According to the report, the Commando troops landed in Kohistan district at midnight on Thursday to aid other forces in the area, confirmed Badakhshan Police Chief Abdul Khaliq Aqsai.

The district had fallen the Taliban on Thursday evening.

Women have the power to create real change!

|

Press Conference Invitation

Press Conference Invitation

Dear Sir/Madam,

You are cordially invited for a Press Conference by

Karnataka Election Watch (KEW)

and Association for Democratic Reforms (ADR) to

release

the

”Analysis of Candidates Contesting the 2018 Karnataka Assembly Elections”

.

Details of the Press Conference:

Venue:

Press Club,

Bangalore

Date:

6

th May

, 201

8

, Sunday

Time:

4 PM to 5 PM

Yours Sincerely,

Quake 6.1 M Luzon

M6.1 – LUZON, PHILIPPINES

Preliminary Earthquake Report

Magnitude 6.1

Date-Time

5 May 2018 06:19:05 UTC

5 May 2018 14:19:05 near epicenter

5 May 2018 10:19:05 standard time in your timezone

Location 14.497N 123.931E

Depth 17 km

Distances

58 km (36 miles) NNW (332 degrees) of Pandan, Catanduanes, Philippines

127 km (79 miles) NE (39 degrees) of Naga, Luzon, Philippines

149 km (93 miles) N (8 degrees) of Legaspi, Luzon, Philippines

319 km (198 miles) E (92 degrees) of MANILA, Philippines

Location Uncertainty Horizontal: 7.7 km; Vertical 4.1 km

Magnitude 6.1

Date-Time

5 May 2018 06:19:05 UTC

5 May 2018 14:19:05 near epicenter

5 May 2018 10:19:05 standard time in your timezone

Location 14.497N 123.931E

Depth 17 km

Distances

58 km (36 miles) NNW (332 degrees) of Pandan, Catanduanes, Philippines

127 km (79 miles) NE (39 degrees) of Naga, Luzon, Philippines

149 km (93 miles) N (8 degrees) of Legaspi, Luzon, Philippines

319 km (198 miles) E (92 degrees) of MANILA, Philippines

Location Uncertainty Horizontal: 7.7 km; Vertical 4.1 km

Two Group of Ministers constituted

Two Group of Ministers Constituted to consider the issues relating to Incentivizing digital payments in the GST regime & Imposition of Cess on Sugar under GST

Subsequent to the decisions taken in the 27th GST Council meeting held yesterday i..e 4th May 2018, two Group of Ministers (GoMs) have been constituted.

The first GoM shall consider the issues relating to “Incentivizing digital payments in the GST regime”. Shri Sushil Kumar Modi, Deputy Chief Minister, Bihar is convenor and other members of this GoM are Shri Nitinbhai Patel, Dy. Chief Minister, Gujarat; Capt. Abhimanyu, Excise & Taxation Minister, Haryana; Dr. Amit Mitra, Hon’ble Finance Minister, West Bengal and Shri Manpreet Singh Badal, Hon’ble Finance Minister, Punjab.

The Second GoM shall consider issues relating to “Imposition of Cess on Sugar under GST”. Shri Himanta Biswa Sarma, Hon’ble Finance Minister of Assam is convenor and other members of this GoM are Shri Rajesh Agrawal, Hon’ble Finance Minister, Uttar Pradesh; Shri Sudhir Mungatiwar, Hon’ble Finance Minister, Maharashtra; Shri D. Jayakumar, Minister for Fisheries and Personnel & Administrative Reforms, Tamil Nadu and Dr. T.M. Thomas Isaac, Hon’ble Finance Minister, Kerala. Both the GoMs shall submit their reports within a period of 15 days.

|

Punjab history is an Indian History

Briefing media Punjabi Intellecuals said the punjab board of education has deliberately made punjab history with tag of Sikh history and has marginalised its ethos of bravery and marshal qualities.Punjab being buffer state with various kingdom has always been rock solid border for invaders to intrude in main land India.

Punjab history is not state history but a proud national history and therefore 12 th class text book Sikh history labeling is not community history but it is chapter of Indian history.Those present VC Dr Jaspal Singh, Ex RS Member Trilochan Singh brought to the notice of media that chapter 22 of text book of 12 class has been removed which is deliberately done to keep youngster ignorance of punjab history which is full of nationalism and love of patriotism. Further added to the media by abridging or briefing the Punjab history is diluting the national history.Punjab lies on North West boder was chiefly instrumental in halting invaders from time to time during ancient and medivial history and is full of praises of patriotism and marshal attitude any step to diluting the Punjab history by its education board is step towards diluting nationalism and patriotism.

Addressing media the spokesperson of Punjabi Intelleucals said it is an interest of all Indians if governments draft monitoring council under Ministry of HRD to get stock of the text book actual blurring from the subject.

Sikh History taught in 11 class in open schools is not right criteria as those students appearing for board examination go for 12 class text books and therefore nefarious design to dilute ot sideline Punjab history in true spirit.

DoT bans multiple SIMs

The new norms came into effect on Friday with the Department of Telecommunications (DoT) amending the customer verification norms for mobile phone users.

Scores of subscribers have multiple SIMs with several owning more than 100, a government official said. Telecom companies, desperate to add subscribers, have been lenient in checking multiple connections and do not verify credentials of such users.

Scores of subscribers have multiple SIMs with several owning more than 100, a government official said. Telecom companies, desperate to add subscribers, have been lenient in checking multiple connections and do not verify credentials of such users.

Earlier, operators were offering free and pre-activated prepaid connections with SIMs at their company-managed outlets or franchise across the country. According to new customer verification norms, activated prepaid SIMs have been banned as reported by Mail Today on November 3.

The newspaper on October 30 had reported on how security agencies are concerned over growing misuse of SIMs and have asked DoT to expedite the process of forming a mechanism through which database of Unique Identification Authority of India could be shared to verify credential of subscribers.

According to industry insiders, there are almost 25-30 per inactive connections out of the total 94 crore mobile phone subscriber base as revealed by the Telecom Regulatory Authority of India (Trai). The inactive connections were mostly owned by subscribers who had multiple SIM cards.

According to industry insiders, there are almost 25-30 per inactive connections out of the total 94 crore mobile phone subscriber base as revealed by the Telecom Regulatory Authority of India (Trai). The inactive connections were mostly owned by subscribers who had multiple SIM cards.

While telecom companies have been adding subscribers on an average of over 20 lakh per month, they have reported a fall in customer addition since August this year. During September, there was a drop of 0.2 per cent while it was 2.5 per cent in October

Round Table with Chair IBBI & stakeholders

Round Table Industry Expert Meeting

Issues In Implementation Of IB Code 2016

08th May 2018, Hotel The Claridges, New Delhi.

Round Table Session Chairman

Dr. M.S. Sahoo, Chairperson, Insolvency and Bankruptcy Board of India (IBBI)

Greetings From ASSOCHAM,

The IB Code 2016 (“The Code”) is a landmark piece of legislation amongst a horde of path breaking reforms brought in by the current Government. This single piece of legislation has allowed us to jump several places in the world ranking on ease of resolving insolvencies. The intent of the Code has been clearly based out of the Bankruptcy Law Reforms Committee Report of November 2015 which laid the foundation for the IB Code. Based on BLRC recommendations, The IB Code empowers the financial creditors / lenders (Committee of Creditors (CoC)) with exclusive rights and privileges in the CIRP and authorizes them solely to decide the fate of the corporate debtor and its other stakeholders such as the unsecured creditors, equity shareholders, employees and workers, etc…. whether revival or liquidation. However, While the BLRC Report specifically highlights the duties and responsibilities of the CoC members and its reasoning’s behind putting all the powers in the hands of financial creditors, the same is missing from the final piece of IB Code or its regulations. Based on last 15 months of the functioning of IB Code, it would help if the Board could issue Regulations providing for the duties and responsibilities of COC members making them accountable for their decisions which they take during the course of the resolution process since they owe a fiduciary duty to all the other stakeholders as well.

To address these issues in the interest of the economic development of the nation and to prevent liquidation of the viable companies, an immediate intervention is required by way of issue of urgent guidelines or regulations to regulate the CAC members.

In this backdrop, ASSOCHAM with Insolvency & Bankruptcy Board of India (IBBI) is conducting a round table meeting on IBC for discussing some of the major challenges and issues being faced under the IB Code 2016 and a possible alternative plan. The round table meeting will be addressing the concerns over the Ordinance on IB Code 2016, No incentive to Banks, Accountability, IRPs and many other key issues.

Target Audience:-

· Insolvency Professionals

· Banks

· Financial Institutions

· Government Officials and Regulators

· Corporates

· Entrepreneurs

· Real Estate Investors

· Consultants

· Tax Consultants and CAs

· Asset Reconstruction Companies

· Law Firms

Key Areas of Discussions:-

· Proposal for Invoking Personal Guarantee in Insolvency Resolution

· Staggering of MTM Hit

· Ordinance on IB Code 2016

· No incentive to Banks

· Accountability

· IRPs

· Quorum & Voting at CoCs

· Dissenting Financial Creditors

· Payment to Operational Creditors

The deliberations at this highly interactive round table session will serve as a game-changer and help authorities in addressing the apprehensions and issues raised by different stakeholders.

We are pleased to inform you that Dr. M.S. Sahoo, Chairperson, Insolvency and Bankruptcy Board of India (IBBI) has very kindly agreed to be the session chairman for this round table meeting.

In this regard, We would like to invite you as per the attached registration form to attend the round table meeting schedule to be held on 08th May 2018 at Hotel The Claridges, New Delhi

Your participation would add immense value to the content of the conference.

We look forward for your kind confirmation.

Sincerely,

Kushagra Joshi

The Associated Chambers of Commerce and Industry of India

Banking & Financial Services,

5, Sardar Patel Marg, Chanakyapuri,

New Delhi – 110021

Mob:+91-8447365357

Phone: +91- 11- 46550624

Fax: +91- 11- 46536481/82